A few months back, Maruti Suzuki decided not to launch electric vehicles until 2025. Let’s discuss today whether that is a sensible decision when electric vehicles are the most upcoming category of vehicles in the future, or is it going to become the Kodak of the automobile industry?

The EV Market till now

Though the country’s EV targets are ambitious, we need to look into the current EV market to understand Maruti’s strategy.

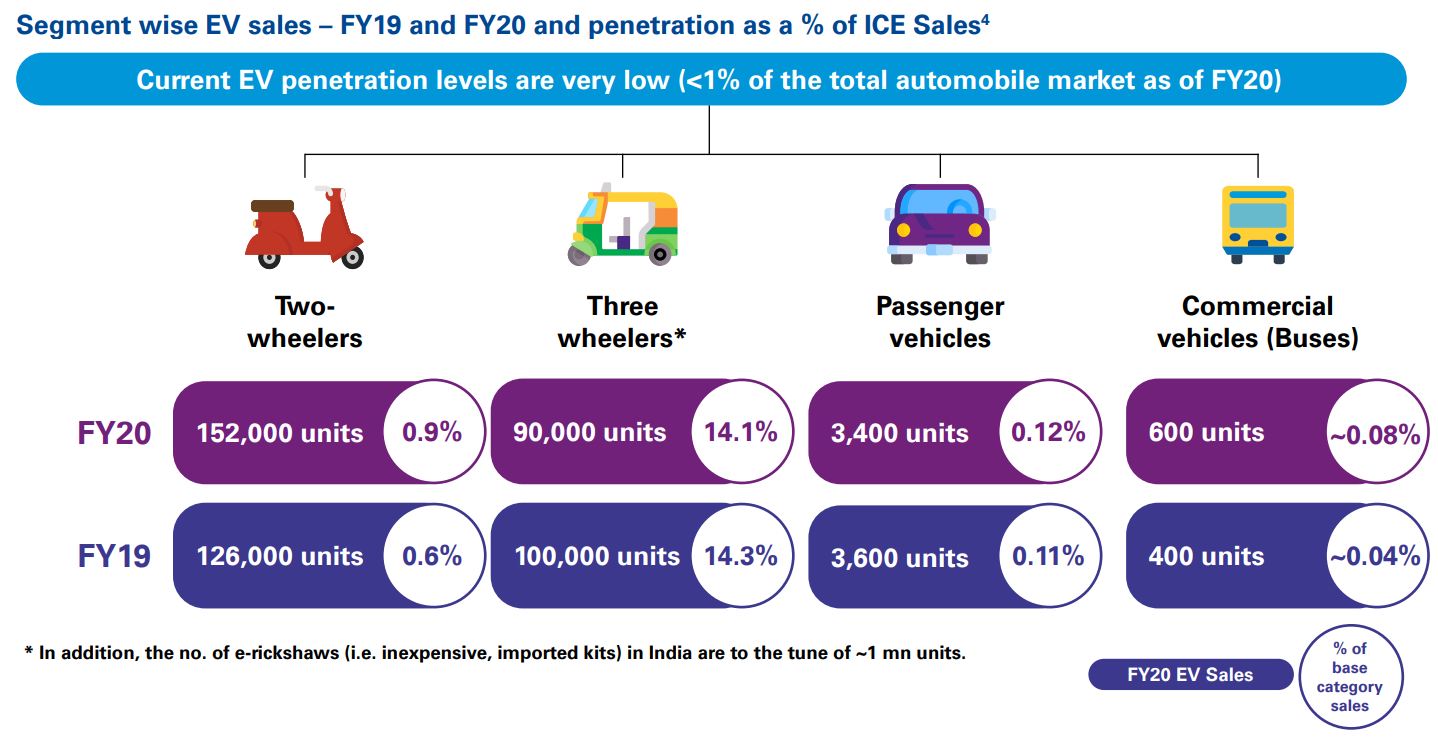

Let us look at the number of EVs sold in the Indian market over the past years.

As can be seen above, in 2020, just 3,400 electric cars were sold, which is around 0.12% of the total passenger vehicle sales.

In the first three quarters of 2021, around 10,000 electric cars were sold, which is still a very tiny percentage of the market.

Why is EV Sales so low?

I agree that EV Sales are going to grow exponentially over the next 5 years as the infrastructure and technology develop. However, we need to analyze why many car buyers are not switching to EVs today.

A very simple reason can be attributed to the limited number of choices available to a customer. But, other than that also, there are other factors at play:

1. Battery Capacity

Significant psychological anxiety involved around buying EVs is its driving rangtheirnd battery capacity. The battery capacity of the best-selling EV in India – Tata Nexon EV, is 30.2kWh with a claimed distance per charge of 312 km/full charge. To put things in perspective, a Nexon petrol variant can travel around 750 km on a total fuel capacity (44 liters * 17 kmpl mileage on average).

2. Charge Waiting Time

There are two types of charging points for EVs:

1. AC/Slow Charging: This is the charging type installed in the homes of EV owners and parking spots.

2. DC/Fast Charging: These charging stations quickly recharge EVs and are found along highways. Even with the most advancements in technology, charging time still comes to around 10 minutes.

The bottom line here is that despite such technologies being developed, the fact remains that EVs will always take more time to get ready for the next trip as compared to an ICE car.

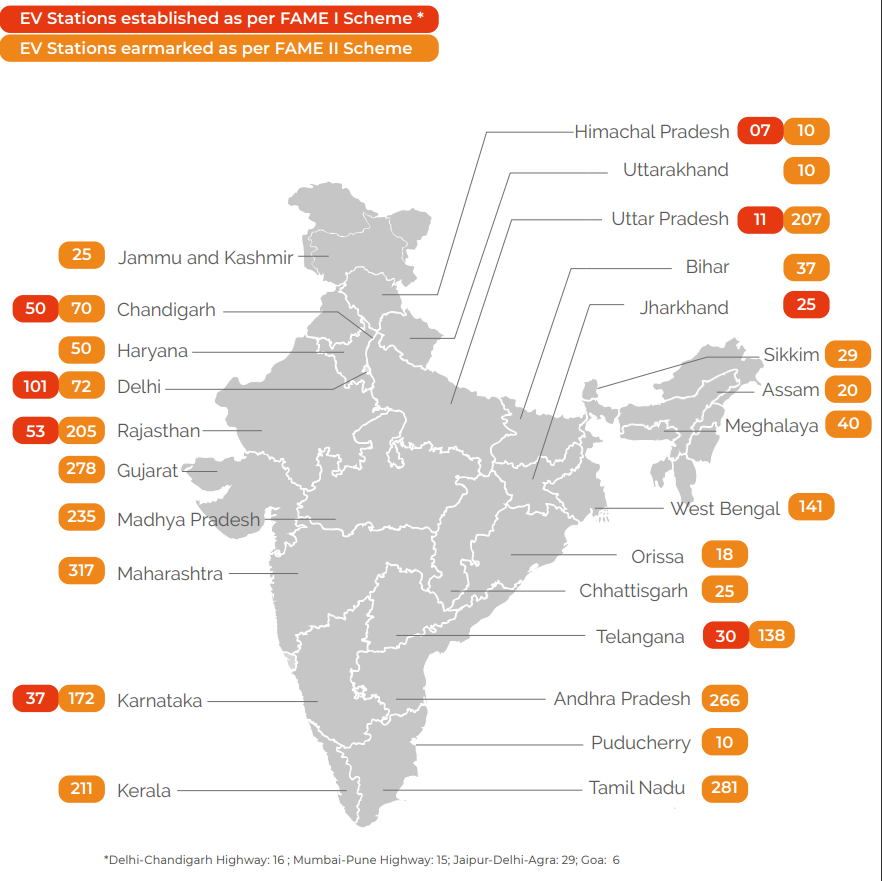

3. Charging Infrastructure

The EV Charging Station infrastructure is currently in its early stages, with around 3,400 charging stations and 4,300 charge points until FY2021. To put things in perspective, there are over 60,000 petrol stations in India.

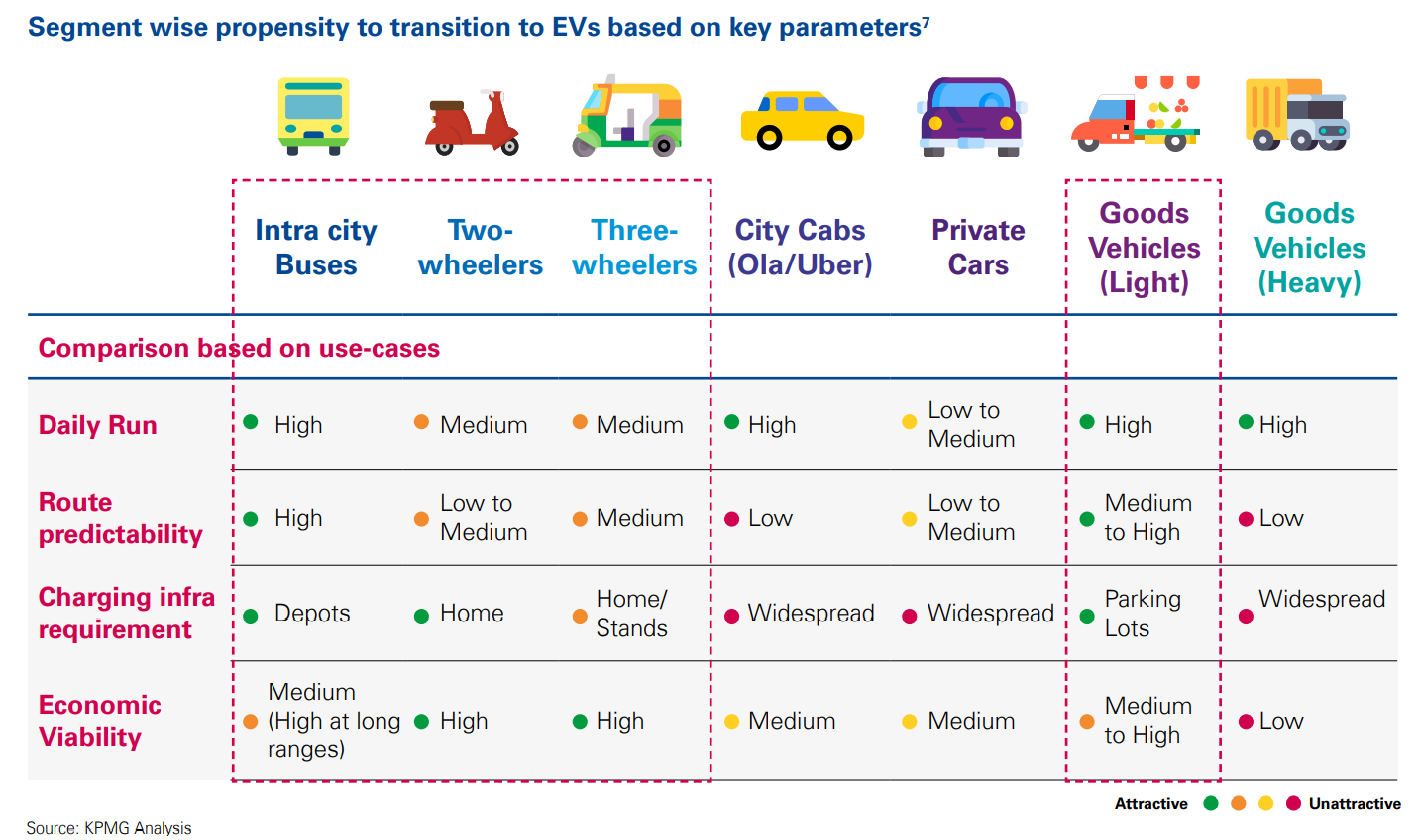

4. Economical Viability

Based on the premium price paid on electric vehicles over their petrol and diesel cars, as well as the savings in the daily running costs of fuel, the economic viability for EVs can only be seen for commercially used vehicles with high amounts of daily run.

For private cars, the same seems to be comparatively low. This is especially true when we take into account the expected resale price of an electric vehicle purchased today after 8 years (the warranty period covered by most electric vehicle manufacturers). Since the EV industry is in a nascent stage, a lot of advancements can be expected in the EV industry over the next few years, especially in the current deal-breaker for many customers – its battery capacity. Thus, we can expect that the resale value of a current EV cannot be expected to be much.

What will be the point of inflection?

So then, when will EVs make it to the mainstream market? This point of inflection will happen when the following 2 lines cross paths:

1. Reducing Cost of owning EVs, owing to lower costs of battery with advancements in its technology as well as lower factory costs due to economies of scale.

2. Increasing Cost of owning ICEs, owing to increasingly stringent emission norms for cleaner environments and rising fuel prices.

This is expected to come somewhere between 2028-2030, where its market share is expected to be around 10-15%.

Maruti’s strategy involves waiting for this inflection point to come.

Maruti’s Strategy

Maruti sells its products through 3 different channels:

1. Nexa – Channel for selling premium Maruti cars.

2. Arena – Channel for selling other Maruti cars.

3. Commercial vehicle sales

(Note: There is another channel called True Value, which is for used cars and that is not covered in the analysis).

The majority of Maruti’s sales come from the Arena product catalog (~75% in number in the past 3 FYs). This comes to say that even today, the major customer base of Maruti revolves around the price conscious middle-income group.

Accordingly, Maruti’s strategy has always revolved around large-scale production of its car models to make them economical for the masses while maintaining its quality standards.

Thus, Maruti has made a conscious decision of deferring its entry in the EV segment because of the following reasons:

1. The puny sales numbers EVs are clocking in India

2. Limited ecosystem for charging infrastructure for EVs in India

3. High cost of acquisition for its price sensitive customers without much economic viability over the lifetime of the car

Maruti’s focus till 2025

Well, Maruti is shifting its focus from EVs to CNG, Hybrids, and flex-fuel vehicles.

1. CNG Vehicles

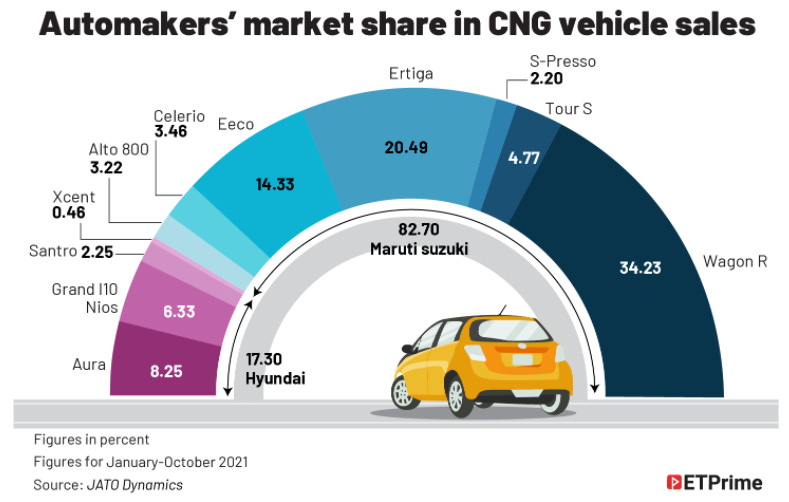

Currently, the CNG market is pegged at 2 lakh units (8.5% of the market) and Maruti holds an 85% share.

It is expected that India’s Gas Demand is likely to grow at an annualized rate of 7.4% and will be a major contributor to the country’s energy transition from ICE vehicles to alternative fuels. Moreover, the gas demand from transportation will grow at 23% CAGR.

2. Flex-Fuel Vehicles

A flex-fuel vehicle does not entirely run on petrol. It is a blend between ethanol and unleaded petrol. This blended petrol is named based on the percent of ethanol present in it. For example, E20 means 20% ethanol and 80% unleaded petrol. As per Niti Aayog’s Roadmap for Ethanol Blending, India aims to only use E20 from 2025-26. since ethanol is more environmentally friendly. Maruti has started working on such vehicles.

The First Mover Advantage

Currently, EV Sales in India revolve around 3 major car brands:

1. Tata with its Tata Nexon EV & Tata Tigor EV (~73%)

2. MG with its MG Hector (~25%)

3. Hyundai with its Hyundai Kona (~1%)

Over the next few years, a series of further electric variants are expected to be introduced by each of these manufacturers. Even Mahindra and Mahindra has planned to launch 16 EV models by 2027. The only other car brand not looking to invest in EVs in India currently is Toyota.

The question arises, whether Maruti will really lose on the first-mover advantage? There can be 2 opinions to this.

1. First, let us assume that Maruti enters the market late in 2025. Even then, because of the extensive distribution network of Maruti, it can easily and successfully launch its electric car, with the right strategy. Moreover, in the current economic scenario and cost considerations, an EV will not be affordable to a price-sensitive Indian customer.

2. On the other hand, it can also be argued that Maruti is focussing too much on the bottom line and in turn, affecting other business aspects such as decreasing customer retention, losing on the initial product development & testing phase, etc.

Conclusion

While Maruti is considering the current demand for EVs as a deterrent to entering into the EV industry, other brands like Tata and Hyundai are taking the first-mover advantage to form a long-lasting image of being the first brands to introduce EV in the Indian markets.

As consumers, amidst the rising fuel prices with no plans of the Government to reduce them in the near future, having an electric vehicle as an alternative, is going to be a boon for us.

So, what do you think? Is Maruti justified in its decision? If yes, then is Hyundai making the wrong decision, planning to invest around Rs. 4,000 crores towards electrification? Well, let me know in the comments below.

Leave a Reply